When commissions are transparent and error-free, they motivate. Prowi handles both.

When commissions are transparent and error-free, they motivate. Prowi handles both.

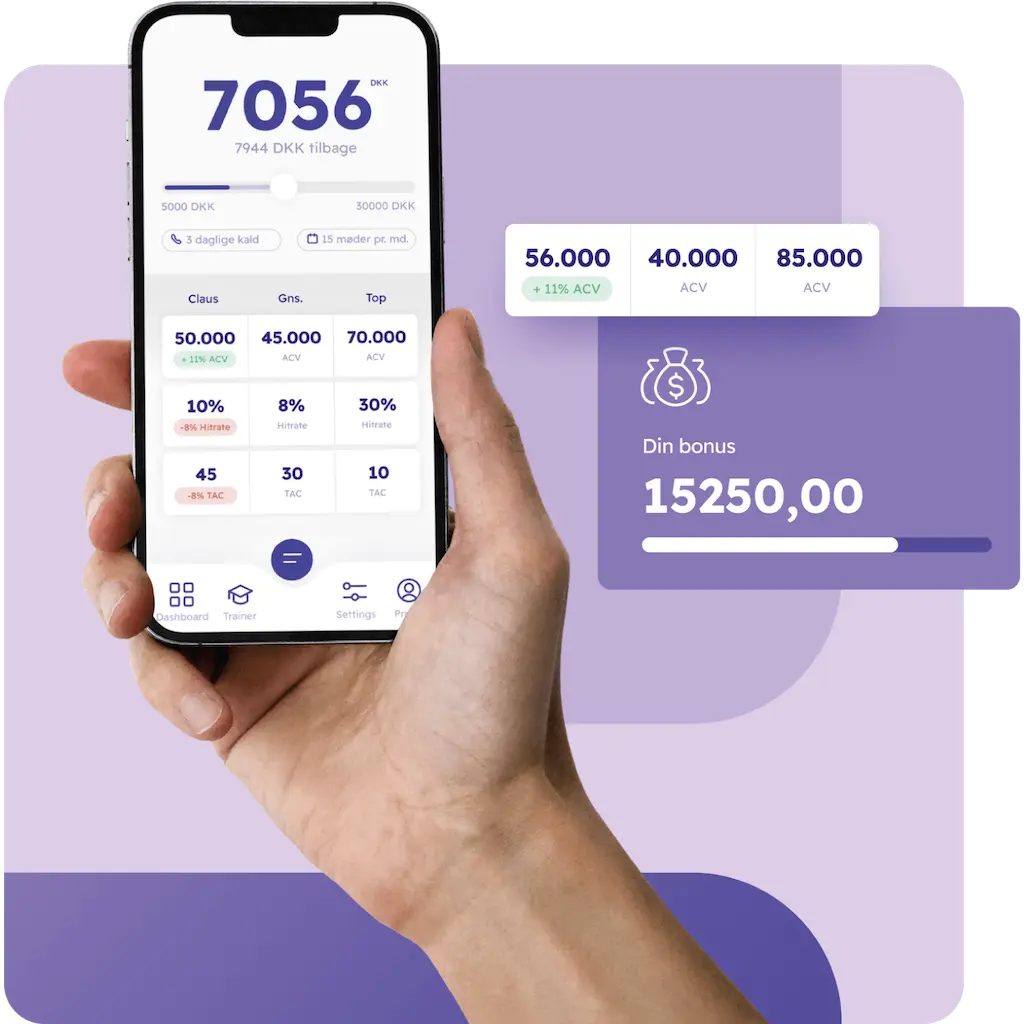

See commission calculated automatically from deal to payroll. Prowi handles every type of incentive model, no matter the complexity.

Shift from managers and reps keeping their own records to spending time on what really drives the business: closing more deals.

Do your sales reps understand their compensation plan?

If they cannot see how commission is calculated or what they stand to earn, your incentive plan can backfire. The result is mistrust and lower performance.

Prowi delivers a simple view of earnings, instant recognition, and a full picture of what your incentives can achieve.

![[interface] screenshot of the core features interface (for an AI marketing tech company)](https://cdn.prod.website-files.com/6853f29490f75918cfe11ed3/6855148f514f8af0a7611071_prowi-app-1500x1500.png)

Get real-time visibility on earnings, instant performance insights, and error-free payouts from CRM to payroll. Replace spreadsheets with a single source of truth that builds trust, cuts admin, and accelerates revenue.

![[interface] image of smartphone in use, user interaction with software (for a consumer apps)](https://cdn.prod.website-files.com/6853f29490f75918cfe11ed3/68551490ef80cedfa62e2cf2_prowi-dashboard-1500x1350.png)

Customer Stories

See how teams turn goals into motivation.

![[headshot] image of customer (for a home inspector)](https://cdn.prod.website-files.com/6853f29490f75918cfe11ed3/68553cee5de802c793897d5e_1746020497639.jpeg)

After years of experience with commission calculations for teams, I can honestly say that it has never been easier than after we started using Prowi.

![customer giving a testimonial for an AI biotech company [headshot]](https://cdn.prod.website-files.com/6853f29490f75918cfe11ed3/68553d7ff8f48051c4389421_images.jpeg)

In particular, the monthly approval flow feature makes the process transparent, so that the commission is settled correctly.

![customer support representative [headshot]](https://cdn.prod.website-files.com/6853f29490f75918cfe11ed3/68553d7e09617b1c67d04f5a_tk.png)

I'm a big proponent of making things simpler with the tech products I've created. Prowi solves a challenge I've always had around calculating commission - and it works.

![image of a marine repair service [headshot]](https://cdn.prod.website-files.com/6853f29490f75918cfe11ed3/68553d7e4aa836c2b2245416_download.jpeg)

All the numbers match, it's really nice easy and manageable for me.

Commissions are variable salaries that are paid based on results achieved. Typically, commission is calculated as a percentage of the sales value, say, a sales rep with a 5% commission rate earns $5,000 on a sale worth $100,000. Commission creates a direct link between effort and reward.

A bonus is a one-time payment that is given upon achievement of a specific goal or milestone. Unlike commission, bonuses are not calculated as a percentage of sales, but are a fixed amount paid when the goal is reached. Bonus works best as motivation towards specific goals.

Commission is calculated as a percentage of each sale and drives ongoing activity. Bonus is a fixed amount at milestones and drives towards specific goals. Commission motivates volume, bonus motivates target level. Most successful compensation plans combine both elements.

A commission model is the structure that defines how commissions are calculated and paid. The model establishes the commission rate (how many percent), basis of calculation (what is commission calculated by), payout timing, and any thresholds or accelerators. The choice of model directly affects seller behavior.

The 7 primary models are: Flat commission (same % regardless of quantity), step model (increasing % on higher sales), accelerators (bonus % over quota), coverage contribution based (% of margin), split commission (split among several), draw against commission (advances that are set off) and residual commission (ongoing on renewals).

Commission rates vary by industry: SaaS 5-15%, real estate 20-50%, insurance 10-25%, B2B in general 5-10%. The average variable share for sales reps is 22% of total compensation.: Prowi uses advanced software technology that ensures accurate and reliable calculations. This means that algorithms and computational models are thoroughly tested and validated to ensure accuracy.

Choosing a commission model depends on three factors: What behavior do you want to drive (volume, overperformance, profitable sales)? What is your sales cycle (short, medium, long)? And how mature is your organization? Start simple and increase complexity only when data shows it is necessary.

Split commission is a model in which the commission is shared between several employees who have contributed to a sale. It is typically used when one seller finds the lead (hunter), another closer the deal, and a third handles onboarding. The distribution can be for example 40/40/20 or adapted to your sales process. Split commission ensures fair reward across roles, but requires clear documentation of who contributed when, otherwise conflicts arise.

Proper commission calculation requires three things: a clear formula (e.g. revenue × commission rate), reliable data from your CRM, and consistent rules for edge cases such as returns or discounts. Most errors occur with manual calculations in Excel. Automation with a dedicated system eliminates calculation errors, ensures timely withdrawals, and provides sellers with transparency in their earning.

Upon termination, you must have clear rules for pipeline commission (deals in progress), clawback (refund if customers churn), and payout time. Best practice is to define this in the employment contract. Typically, commissions are paid on deals closed before termination, while pipeline deals are either transferred or shared with the new seller. Avoid conflicts by documenting the rules clearly from the start.

Transparency is achieved by giving sellers real-time access to their commission data: what they have earned, which deals count and when they are paid out. A dashboard showing pipeline value and expected commission motivates far more than a monthly inventory. When the salespeople themselves can see and understand the calculation, questions to the finance department are reduced and confidence in the system increases.

The variable share (commission + bonus) typically represents 20-40% of the total compensation for sellers in Denmark. A higher variable proportion (40% +) attracts top performers and drives aggressive growth, but can create stress and short-term thinking. A lower proportion (20-30%) provides more stability and is suitable for longer sales cycles or account management roles. Match the variable proportion with your sales culture and objectives.

Motivational bonuses require three elements: achievable goals (60-70% must be able to hit target), quick feedback (monthly or quarterly payout), and clear correlation between effort and reward. Avoid too complex structures with many KPIs, since sales reps are best motivated by simple, understandable goals. Consider accelerators that increase the bonus percentage on overperformance to drive extra effort from top performers.

SPIFF (Sales Performance Incentive Fund) are short-term bonuses to drive specific behaviors e.g. extra rewards for selling a new product, booking demos during a launch phase, or clearing inventory items. SPIFFs typically last 1-4 weeks and complement the fixed commission model. They are effective in generating focus and energy, but should be used sparingly so as not to dilute the primary incentive structure.